how much federal tax is taken out of my paycheck in illinois

This tax is to be withheld from the employees paycheck. 10 12 22 24 32 35 and 37.

How To Read Your Paycheck Stub Clearpoint

Our calculator has recently been updated to include both the latest Federal Tax Rates.

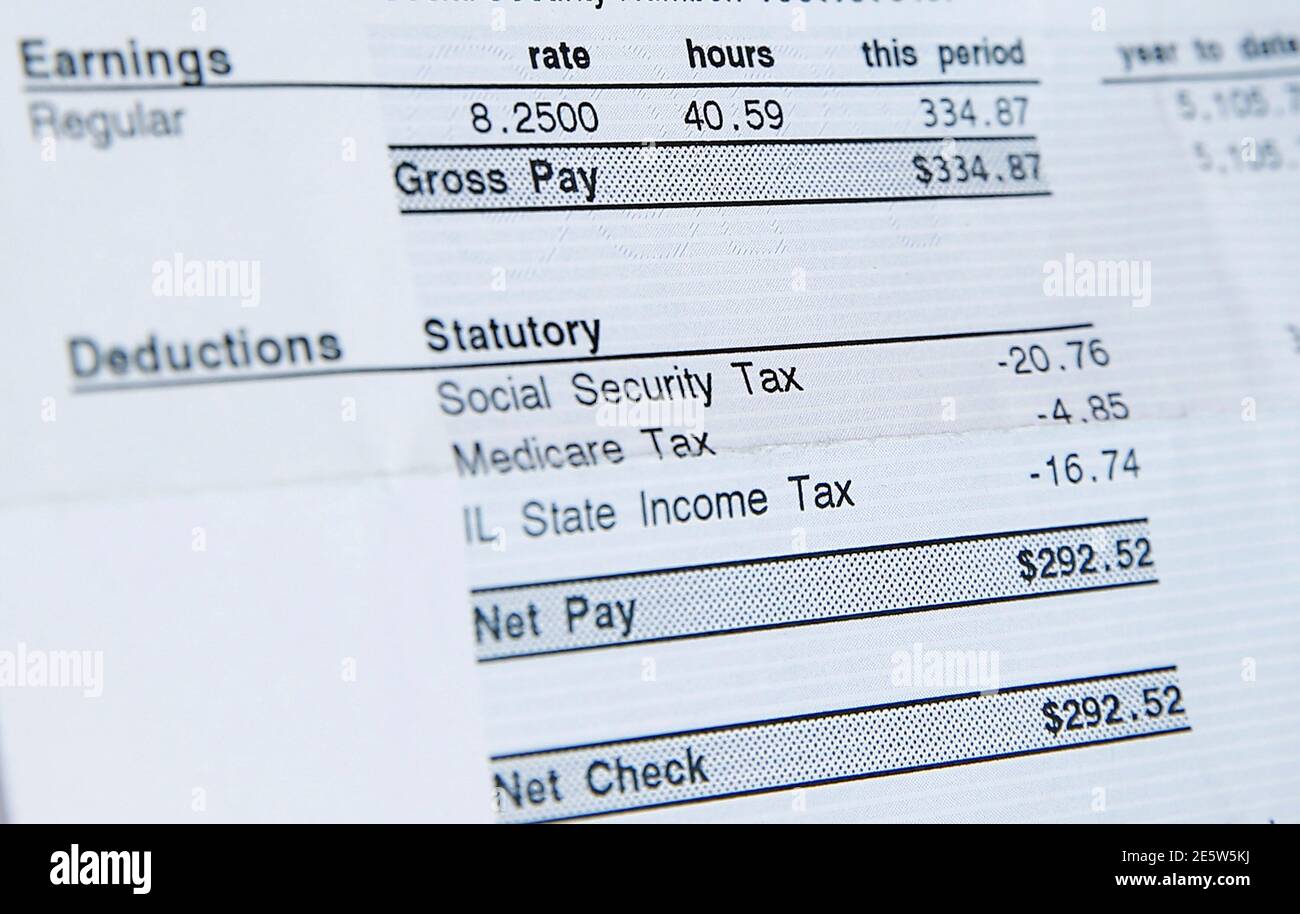

. As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625. The Medicare tax rate is 145. Illinois tax year starts from july 01 the year before to june 30 the current year.

Employees who file for. If your monthly paycheck is 6000 372 goes to Social Security and 87. The Illinois state income tax is a flat rate for all residents.

A single Illinoisan who earns 63000 per year will take home. Yes Illinois residents pay state income tax. How much taxes does illinois take out of paycheck Tuesday May 31 2022.

How much is 75k after taxes in. The federal withholding tax rate an employee owes depends on their income level. Unlike Social Security all earnings are subject to Medicare taxes.

Illinois Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. The federal withholding tax has seven rates for 2021. What Do Small Business Owners Need to Know About Taxes.

Federal income taxes are paid in tiers. How Much Federal Tax Is Taken Out Of My Paycheck In Illinois. You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202223.

How much do you make after taxes in Illinois. Regardless of your filing status the income tax is a flat rate of 495. Illinois paycheck calculator Payroll Tax Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or.

And then youd pay 22 on the rest because some of your 50000 of taxable income falls into the 22 tax bracket. You can claim a tax credit of up to 54 for the state unemployment tax you. If youre married filing jointly youll see the 09 percent taken out.

As you are done with your federal payroll taxes now is time to withhold Illinois state income tax. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. The Illinois salary calculator will show you how much income tax is taken out of.

Rates are based on several factors including your industry and the amount of previous benefits paid. Pay FUTA unemployment taxes which is 6 of the first 7000 of each employees taxable income. The total bill would be about 6600 about 13 of your taxable.

The state charges a flat. Employers in Illinois must deduct 145 percent from each employees paycheck. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Gov Pritzker Should Cut Illinois State Gasoline Taxes They Re Up Over 100 Percent Since He Took Office Wirepoints Wirepoints

Income Tax International Student And Scholar Services

State Individual Income Tax Rates And Brackets Tax Foundation

Dual Tax Status What Does It Mean For Your Pastor American Church Group Illinois

Time To Review W 4 Forms News Illinois State

Paycheck Calculator Take Home Pay Calculator

Illinois Paycheck Calculator Adp

Paycheck Check Up Financial Advisors Reps In Illinois Indiana

A Complete Guide To Illinois Payroll Taxes

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Illinois Paycheck Calculator Tax Year 2022

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Illinois Paycheck Calculator 2022 2023

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

A Recent Paycheck For Delores Leonard Shows Her Hourly Wage Of 8 25 For Working At A Mcdonald S Restaurant The Minimum Wage In Illinois In Chicago Illinois September 29 2014 Leonard A Single

Illinois Paycheck Calculator Smartasset

Garnishing Your Ex S Check For Child Support Or Maintenance In Illinois